After four years of regulatory chaos and government overreach, a federal judge just put a stop to one of the most ridiculous Biden-era rules—letting Americans breathe easy again, at least those who believe in the rule of law and common sense.

At a Glance

- Federal judge vacates Biden CFPB rule banning medical debt from credit reports, ruling the agency overstepped its authority.

- Medical debt will stay on credit reports, maintaining credit industry standards—and some might say, sanity.

- Up to 15 million Americans who would have benefited from the rule now face continued credit score impacts from medical bills.

- The ruling sets a precedent that limits regulatory agencies from inventing new powers without clear congressional authorization.

- Credit industry praises the decision, while consumer advocates and far-left groups lament the loss of a policy they pushed as “protection.”

The End of an Overreach: Judge Halts Biden’s Medical Debt Credit Rule

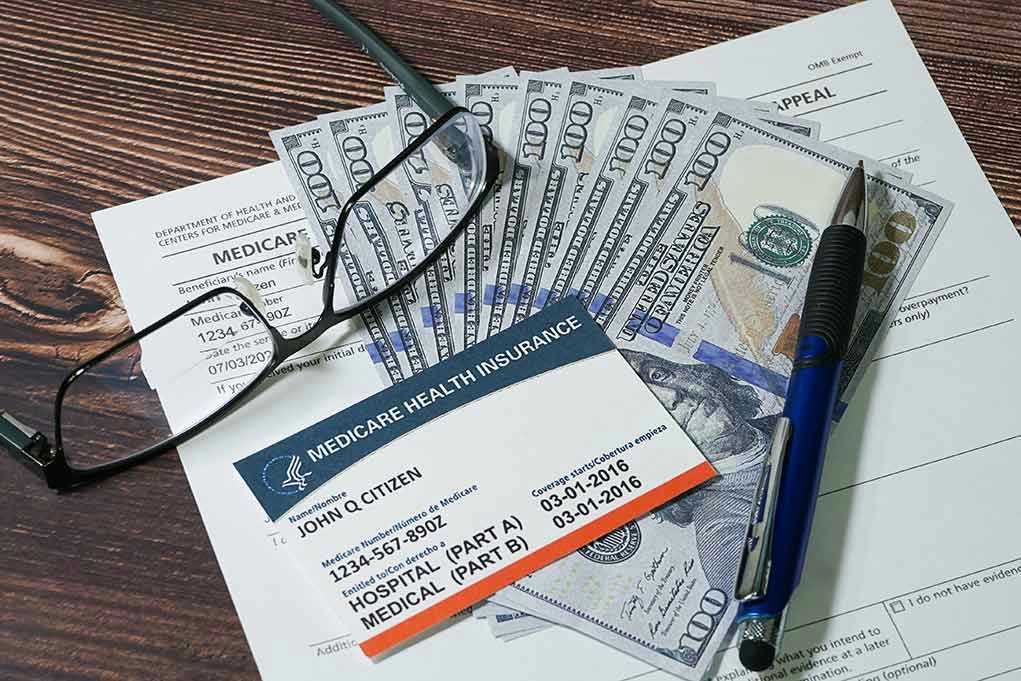

Judge Sean D. Jordan, a federal judge in Texas, delivered a long-awaited reality check to the Consumer Financial Protection Bureau (CFPB) this week. He ruled that the CFPB had no business banning medical debt from credit reports, striking down a rule that would have erased tens of billions in medical debt from the credit scores of millions of Americans. The judge found that the CFPB, under Biden’s watch, had blatantly exceeded its authority under the Fair Credit Reporting Act. For those of us who value the Constitution and the separation of powers, this is a win for checks and balances—not to mention a slap to the face of unelected bureaucrats who thought they could rewrite the law on a whim.

Credit Industry and Common Sense Win the Day

Credit reporting agencies and lenders argued that medical debt, like any other debt, is a legitimate factor in assessing creditworthiness. They pointed out that removing it would distort the accuracy of credit reports and make it harder to judge risk. Judge Jordan agreed, and his decision means that credit reports will once again reflect the full picture of a borrower’s financial responsibility—not a sanitized, government-curated version. This is a victory for the financial sector, but also for anyone who believes that rules should be made by elected officials, not by regulatory agencies acting on ideological whims.

The CFPB, now under new leadership, actually joined the lawsuit against its own rule after the presidential transition. That’s right—the agency that created the rule under Biden ended up arguing against it under Trump. Talk about a reality check. The court rejected attempts by nonprofit groups to defend the rule in the absence of CFPB support, making it clear that activist judges and special interests can’t just step in and take over when the government changes its mind.

The Real Impact: What This Means for Americans

For up to 15 million Americans with medical debt on their credit reports, this ruling means the status quo remains. Medical bills will continue to impact credit scores, which can affect access to loans, mortgages, and other forms of credit. Some will lament this outcome, but let’s be honest—should a credit report really hide debts just because they’re medical? That’s like saying you can ignore your mortgage if you got it while you were sick. The truth is, debt is debt, and pretending it doesn’t exist just makes the system less honest and more prone to abuse.

The ruling also sets a precedent that will discourage future efforts by regulatory agencies to invent new powers without clear congressional authorization. This is a win for limited government and the rule of law, especially for those of us who have watched in horror as bureaucrats tried to rewrite the rules to fit their political agenda. It’s a reminder that, in America, laws are made by our elected representatives—not by unelected officials in Washington.

Expert Analysis: Who Benefits and Who Loses

Credit industry experts are celebrating the decision, calling it a win for the integrity of the credit reporting system. They argue that medical debt is a relevant indicator of a consumer’s ability to pay, and that removing it would make credit reports less reliable. For those who believe in personal responsibility and accurate risk assessment, this is music to the ears.

On the other side, consumer advocates and far-left groups are predictably upset. They claim that medical debt is often involuntary and not a true reflection of credit risk. While there’s some truth to that, the answer isn’t to erase reality from credit reports—it’s to fix the healthcare system so people aren’t drowning in medical bills in the first place. But, of course, that would require real solutions, not just more government overreach.

Legal scholars note that the ruling underscores the limits of agency authority and the importance of clear legislative mandates for significant regulatory changes. In other words, if you want to change the law, get Congress to do it—don’t just hope some bureaucrat will rewrite the rules for you.